Our Products and Services

Member Savings/Deposit

- Minimum monthly deposit: KSh. 500

- Entitles members to loans up to three times their deposits/Savings.

- Earns interest on Member Deposits annually.

- Deposits are reimbursed upon written request, paid after 60 days.

FOSA Savings Account

- Opening fee of Ksh. 500

- Minimum balance 500

- Account holder has access to all credit facilities with flexible terms

- Salary processed through this account.

- Access To Internet/M-banking Services.

- inter-account transfers is Ksh. 50

- Standing orders is Ksh. 200

- Zero Charge Operating account/No ledger fee

Junior Savings Account

- 500/= minimum monthly or periodical lumpsum

- Minimum saving period: 12 months.

- Attracts interest per annum.

- Minimum interest earning balance: Ksh 5,000.

- The account is operated by the parent or guardian (child’s birth certificate is required).

- Full or partial withdrawal is allowed after term maturity (12 months from the fixing date).

Christmas Savings Account

- KSh 500 minimum monthly or periodical lumpsum.

- Withdrawable only in the month of December.

- Minimum saving period: 3 Months.

- Attracts interest per annum.

- Minimum interest earning balance: Ksh 10,000.

- Member to give written instruction in case they want to roll over to a new fixed term.

- Full or part withdrawal allowed after term maturity.

Fixed Deposits Savings Account

- Minimum amount for fixing is Kshs.30,000

- No monthly fees charged

- Interest calculated and paid on maturity. From 3 to 12 months

- No maximum limit

- Earns attractive annual returns of up to 10.5%.

- Roll-Over Option: When your tenure ends, you can seamlessly roll over your principal and interest into a new period.

Group Savings Account

- Ksh 1,000 Account opening.

- Minimum account balance of Kshs.2,500

- The Group to provide minutes authorizing the opening of the account, the names of the signatures and the mandate.

- Provide a current certificate of registration.

- The account to earn interest at the prevailing market rates on savings accounts at the closure of the financial year.

Share Capital

It is a long term investment that gives a member a permanent ownership of the society.

- KSh 10, 000 per member (minimum) payable one-off or in 12 equal instalments.

- Earns dividends annually.

- Shares are transferable to other members upon exit

School Fees Loan

- Caters for primary and secondary fees.

- Maximum Amount: 3 times member’s deposits.

- Maximum period: 12 months.

- Interest charged: 1% p.m. on a reducing balance.

- Loans security accepted: guarantors.

- The fee structure should be attached

Development Loan

- Enables a member to acquire assets & finance other development projects.

- Maximum Amount - 3 times member’s deposits.

- Repayment period - 36 Months.

- Interest charged - 1% p.m. on a reducing balance.

- Loans security accepted: guarantors, title deed

Emergency Loan

- Maximum Amount: 3 times member’s deposits.

- Maximum period: 12 months.

- Interest charged: 1% p.m. on a reducing balance.

- Loans security accepted: guarantors etc.

- Applicant will be required to provide proof of the emergency and attach supporting document.

Advance Loan

- Maximum amount - 70% of Income/Salary.

- Maximum repayment period - 1 month.

- Interest charged - 10% fixed (one off).

- No guarantors required

Special Advance Loan

- Maximum amount - 70 % of three months accumulated Income/Salary.

- Maximum repayment period - 3 month.

- Interest charged - 8% per month.

- Collateral balance of 30%.

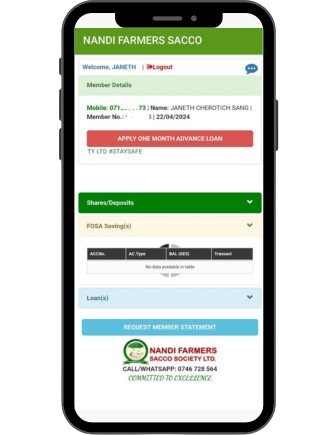

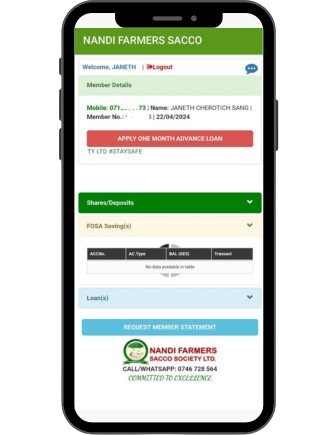

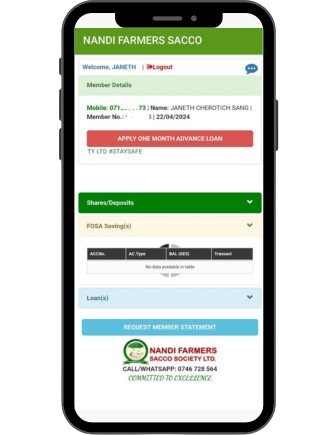

Download our mobile app

With our user-friendly app, you can seamlessly access a range of services, including hassle-free savings accounts and convenient loans – all from the palm of your hand.

Join the growing community of smart savers and borrowers who trust NANDI FARMERS Sacco to help them achieve their financial goals. Download our app today and embark on a journey towards financial empowerment!